Your Smart Savings Guide

Which One is Most Like You?

I don’t currently have a savings account or any other savings.

You aren’t alone. 11% of working-age adults are just like you. Let’s learn more about why saving is important.

I have a savings account with limited funds.

That’s a great start. About ⅓ of people put less than 5% of their take-home pay into savings. Learn how to make the most of it.

I have a savings account with a decent financial cushion.

Awesome work! Did you know 23% of people could not get by for more than three weeks on their savings? Learn to maximize your financial cushion.

Why Are Savings Accounts Important?

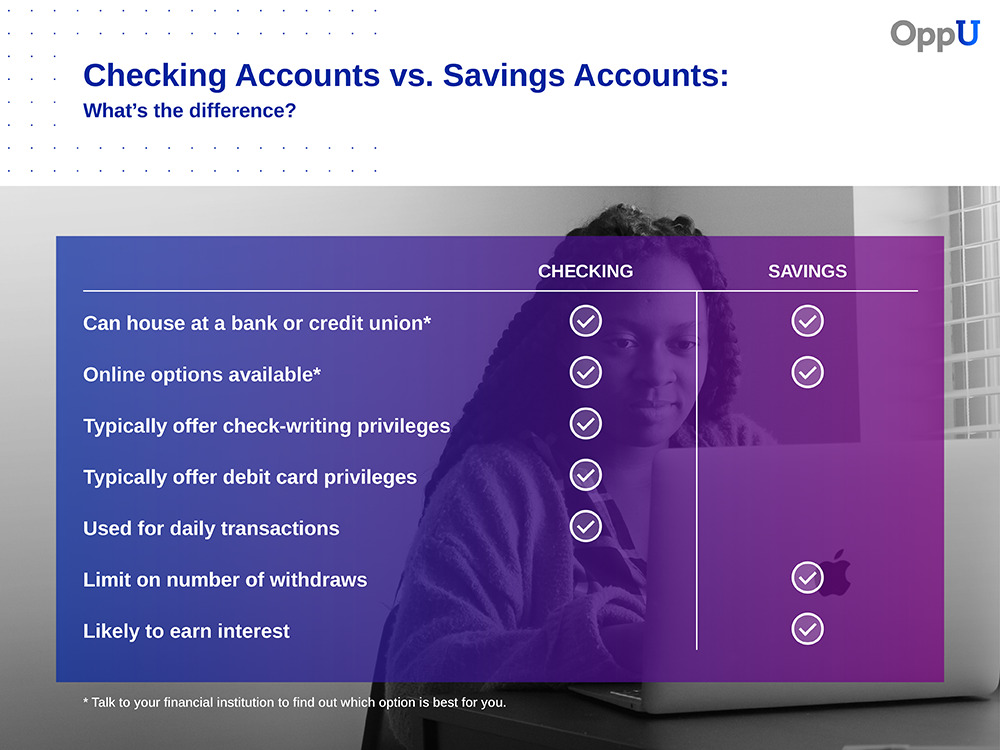

Checking Accounts vs. Savings Accounts: What’s the Difference?

Learn more about how savings accounts work.

Types of Savings Accounts

Savings accounts are not one-size-fits-all solutions. In addition to traditional savings accounts, there are different types to choose from all with their own rules and benefits.

- Certificates of deposit

- College savings accounts

- Health savings accounts

- High-yield savings account

- Money market account

- Student savings accounts

Learn more about 6 types of savings accounts.

Did You Know...

Since March 2020 and the onset of COVID-19, about half (49%) of adults between the ages of 18 and 64 have withdrawn money from their savings to cover a financial emergency.

Tips for Smart Saving

- Start small: Even saving a small amount of money — i.e. $20 a month — can help to prevent a financial crisis. If you’re already saving, consider incrementally increasing your contribution.

- Automate it: Use direct deposit or set up automatic transfers to move your money without any effort on your part.

- Create friction: Avoid the urge to dip into your savings by keeping it at a separate bank or credit union than your checking account.

- Cut waste: Look for areas to cut spending and defer that money to a savings account — even if it's equivalent to a coffee a week.

Bonus Tip: Consider Your Goal

| Short-Term Savings | Long-Term Savings |

| Car downpayment | College |

| Holiday spending | House downpayment |

| Vacation | Rainy day fund |

| Wedding | Retirement |

The bottom line

Life comes with its ups and downs. In fact, 47% of people have withdrawn money this year to cover regular expenses. But honing your saving habits can help to both weather the storms and save for life's celebrations.

Data on this page was derived from the OppLoans Emergency Preparedness Survey, which surveyed 800 U.S. household financial decision-makers in October 2020 regarding their budget and savings practices.