Credit Tier Breakdown, Part 4: Bad Credit

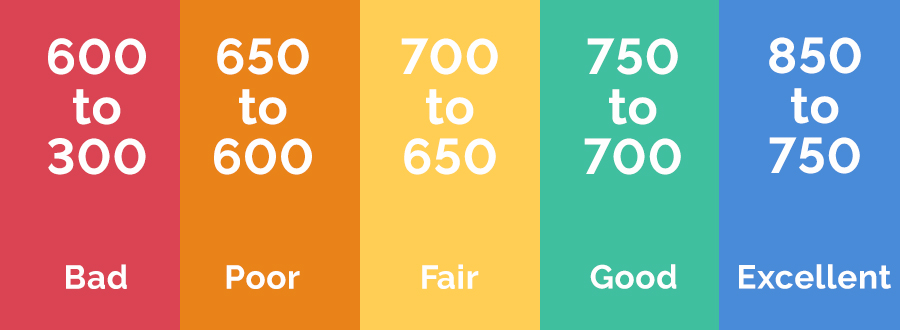

A brief primer on credit score ranges

"Credit scoring agencies have generally stuck with a system of Bad—Excellent,” said Ian Atkins, former General Manager of the Finance Vertical for Fit Small Business.

“That scale can be useful,” said Atkins. "But lenders tend to use a different kind of shorthand that takes into account not only credit history but also other factors, like income and net worth.”

“Prime and super prime (or good and excellent) borrowers are those judged to have very low risk of default,” Atkins says. “That means low debt-to-income ratio, low debt-to-credit ratio, great payment history, long credit history, and good mix of credit types. These borrowers get better rates, better terms, better rewards and incentives, and lower fees on everything from credit cards to mortgages. In other words, it pays to be prime.”

On the other hand, having bad or poor credit—basically, a credit score under 630—and landing in the subprime range doesn’t pay at all. In fact, it’s quite the opposite. Having a credit score in this range means that you will pay more for personal loans through higher interest rates and larger down payments.

What Kinds of Loans Can You Get?

With a credit score under 630, loans from traditional lenders are pretty much off the table. Banks will likely deem you as too risky to lend to at the rates they can offer. You might have better luck with a credit union, but even then, you may come up empty-handed.

You will likely not qualify for a mortgage either, although a credit score of 600 or above might qualify you for a subprime mortgage. These mortgages come with much higher rates than normal mortgages, and some of them come with rates that are “adjustable.” More on those later.

One type of traditional loan that you can qualify for even with a credit score below 600 is a subprime auto loan. However, just as with subprime mortgages, you will probably pay higher interest rates, and you will likely be required to put down a larger down payment in order to secure the loan.

With credit cards, you will see the number of offers you receive in the mail go down if your credit score drops into this range. And the offers you do receive will come with much lower credit limits, high-interest rates, and might even be for “secured” cards that require collateral.

If you have bad credit and need to borrow money, your options will be limited and your rates will be high. If you have a credit score under 600, the only loans you are likely to qualify for are “bad credit” and/or “no credit check” loans.

What are Bad Credit and No Credit Check Loans?

While there are many legitimate lenders who lend to folks with bad credit, there are also lots of predatory lenders who are simply looking to take advantage of folks who don’t have many options.

Regardless, the principals for these loans could be smaller than traditional loans, and the interest rates could also be much higher.

The reason for this is simple: the lower a person’s credit score, the bigger risk they pose to a lender. A credit score below 630 indicates that you have a history of not making payments on time, taking on too much debt, and maybe even defaulting on loans entirely.

Bad credit lenders charge higher rates in order to guard against the higher likelihood at which their borrowers will default on their loans. If the lender didn’t do this, they would go out of business.

The two most common kinds of bad credit loans are payday loans and title loans. Both are short-term loans with average interest rates of around 300%.

Payday loans are small-dollar loans that only average about 14 days, and they are often “secured” by a post-dated check that the borrower makes out to the lender for the amount owed. On the due date, the lender deposits the check, and the loan is repaid.

The appeal of payday loans is that borrowers can repay the loans quickly, but the short payment terms can also make a loan harder to repay. Since borrowers have to pay the loan back in full, rather than a little bit at a time like they would with an installment loan, the short turnaround can be challenging.

In situations like this, the payday lender will offer to roll the loan over, meaning that the borrower pays only the interest owed on the loan and then gets a new repayment term… complete with an additional interest payment. Rolling a loan over multiple times can drastically increase the cost of borrowing while leaving the borrower no closer to repaying the principal than they were when they first took it out.

With title loans, the borrower puts up their vehicle as collateral. This allows someone to borrow a larger amount of money, but it also means they could lose their vehicle if they can’t repay the loan. The average term for a title loan is one month, and the average interest rate is 25%. With high rates and short terms, loan rollover can be a big problem for title loan customers as well.

There are also many lenders who offer installment loans to people with bad credit. These loans come with longer repayment terms than payday or title loans, usually somewhere between three and six months. Installment loans are paid off in a series of equal, regular installments, which can make repaying the loan a more manageable process.

The term “no credit check” loans describes loans in which the lender does not perform a hard credit check during the application process. A "hard credit check" can temporarily lower a person’s credit score, which makes no-credit check loans appealing to folks who already have bad credit.

Some bad credit lenders do perform a "soft credit check" during the application process, which returns less information than a hard check, but gives the lender a basic understanding of the borrower’s ability to repay their loan.

In general, a lender who performs a "soft credit check" is likely preferable to one who performs no credit check at all. It shows that the lender is considering your ability to repay your loan the first time instead of hoping you roll it over again and again and again.

What kind of interest rates can you get?

According to the MyFico Loan Savings Calculator, a person living in Illinois with a credit score of 620 who took out a $300,000, 30-year, fixed-rate mortgage would get an interest rate of 8.16% and would pay over $116,700 more in interest than a person with a credit score of 760.

However, some subprime mortgages have interest rates higher than that.The thing to watch out for with subprime mortgages is rates that are “adjustable.” Oftentimes, these mortgages start with a low “teaser rate” that can make the mortgage seem more affordable than it really is. When the teaser rate expires, these adjustable rates will shoot up, taking your monthly payments with them. This can lead many borrowers to default. Adjustable rate mortgages were a huge factor in the financial crisis in 2008.

The MyFico Loan Savings Calculator also estimates that a person in Illinois with a credit score of 590 would pay an interest rate of 17.89% for a 30,000, 60-month auto loan. They would end up paying over $94,000 in interest more than a person with a credit score of 720 and an interest rate of 7.55%.

When it comes to unsecured personal loans, people with bad credit will generally be looking at an annual interest rate above 36%, or 3% per month. While there are above 36% lenders that will give you fair terms, reasonable rates, and good customer service, there will also be lenders in this space who are looking to take advantage of you, so be careful!

With payday and title loans, the interest rates will vary from lender to lender and from state to state. Even though the rates will vary, they will still be incredibly high.

Payday loans are generally the most expensive and risky way for people with bad credit to borrow money. Do your research when shopping for bad credit and no credit check loan to make sure that the lender you’re working with gives you the best possible rates and most reasonable terms.

What can I do to raise my credit score?

“I'd like to be optimistic about the purchasing power of a person with a credit score below 550,” says Roslyn Lash AFC®, Founder of Youth Smart Financial Education Services. But she adds that “their life in terms of credit will be poor.”

Here are four actions that Roslyn recommends people with poor credit scores can take to repair their credit:

- Prepare a Budget. This is the first step because it will tell you how much money you have left after reducing non-essentials. This extra money can be applied toward your bills.

- Pay all your bills on time. Make a schedule of when your bills are due and use e-bills and auto-pay to make sure that you pay the correct amount when it’s due.

- Eliminate debt! Check out the debt elimination plan outlined at PowerPay.org, and also look at strategies like the Debt Snowball and the Debt Avalanche. Whatever you decide to do, you need to make a plan, and then stick to it

- If you need assistance, seek financial coaching.

If you have additional questions about credit scores, personal finance, or getting a loan with bad credit, visit our Resources page.

Ian Atkins (@FitSmallBiz) was the General Manager of the Finance Vertical for Fit Small Business. He covered small business finance with a focus on traditional and alternative small business lending.

Roslyn Lash (@RosLash) is an Accredited Financial Counselor and the founder of Youth Smart Financial Education Services. She specializes in youth financial education, and adult coaching and works virtually with adults helping them navigate through their personal finances i.e. budgeting, debt, and credit repair. Her advice has been featured in national publications such as USA Today, TIME, Huffington Post, NASDAQ, Los Angeles Times, and a host of other media outlets.

Please note the below article contains links to external sites outside of OppU and Opportunity Financial, LLC. These sources, while vetted, are not affiliated with OppU. If you click on any of the links you will be sent to an external site with different terms and conditions that may differ from OppU’s policies. We recommend you do your own research before engaging in any products or services listed below. OppU is not a subject matter expert, nor does it assume responsibility if you decide to engage with any of these products or services.