Savings Worksheet to Crush Your Money Goals

Savings goals are a helpful tool — whether you want to save for vacation or retirement. It’s an important habit to develop for long-term financial security.

But setting and achieving goals takes patience and dedication.

Ready to make a change and take control of your financial future? Here’s how to do it. Follow these steps and download our free savings worksheet to get started!

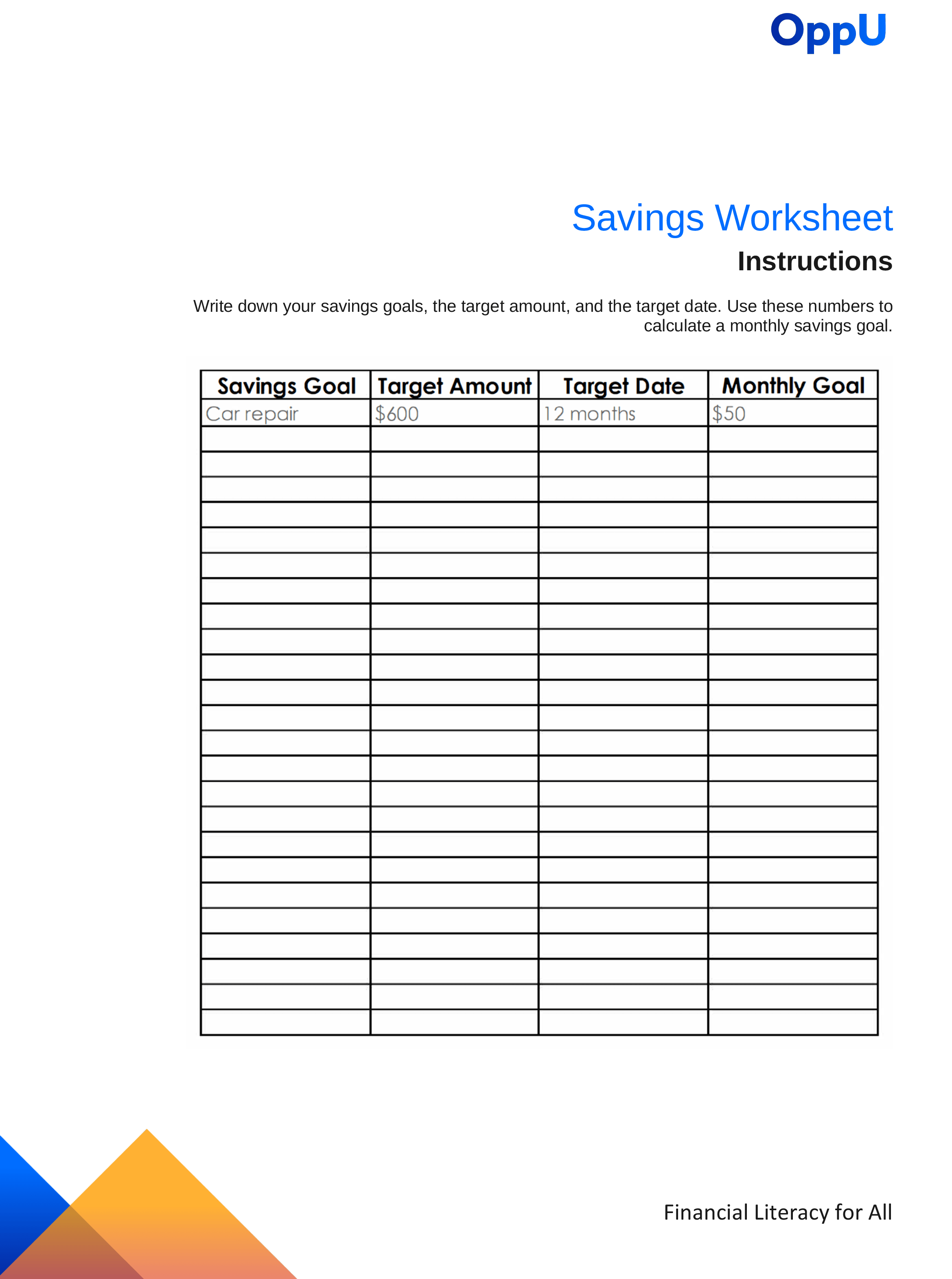

Free savings worksheet

DOWNLOAD THE SAVINGS WORKSHEET

How does the savings worksheet work?

Put pen to paper and brainstorm your savings goals. Identify the financial behaviors that are contributing to or hindering your goals. What do you want to start doing, keep doing, or stop doing?

For example:

- Start saving for a big purchase, like a car or a house.

- Keep contributing to a 401(k) with an employer match.

- Stop racking up unnecessary debt.

Now to use the savings goal worksheet, you’ll need to do simple math. List the total dollar amount needed to fund goal number one. Divide the total by the number of months until the goal deadline — whether it’s a few months or several years. The result is the amount of money you need to save each month in order to hit your total goal by the end of the deadline.

For example, if you need to save $3,000 for a down payment on a car in one year, you'll need to save $250 each month — $3,000 divided by 12 months = $250.

Crush your savings goals in 4 simple steps

The financial goals worksheets will help you decide where you want to go and how to get there. These steps will help make it happen.

Step No. 1: Decide what you want to achieve

The first step to achieving a savings goal is knowing what the goal is. Ask yourself, “What do I want to achieve? What am I saving up for?”

A savings goal may be short- or long-term. For instance, a short-term goal is achievable in a few months, like purchasing a new phone or taking a vacation. A long-term goal is achievable after several years, like making a down payment on a house or saving for retirement. But most goals will likely fall somewhere in the middle, like paying off a debt.

Determine where your goals fall in terms of timeline. This is also a useful step in calculating how much you will need to save each month by spreading the total amount across the deadline.

Remember, the best goals are realistic and take into account your current financial situation. There’s no reason to set yourself up for failure. Avoid setting a savings goal that is too difficult to achieve or a financial behavior that is unlikely to change.

Step No. 2: Set up a dedicated savings account

Banks often allow account holders to create multiple savings accounts, or to set up savings goals within a single account.

Consider breaking up savings goals into different accounts, such as an emergency fund, a vacation account, a wedding account, and so on. When each goal is separate, it’s easier to track progress. For added peace of mind, there’s no need to worry about confusing goal totals. But managing several accounts will take work. And it’s not always possible depending on the bank.

Alternatively, some banks have a feature that allows users to create different “buckets” within one savings account. Rather than having multiple accounts, these savings buckets are an easier and cleaner way to organize goals.

Step No. 3: Free up money to save

Now for the fun part — turning a savings goal into reality. To fund a savings goal, you need to adjust your budget. That money needs to come from somewhere.

If your savings rate exceeds your goal, then you have an excess of money. Congrats! Your goal is progressing toward being fully funded. Use any additional money to accelerate your goal or add a new goal.

If your goal costs more than the amount you save, however, then it’s time to reevaluate your priorities. Here are five actions to help you get back on track:

- Cut your spending by reevaluating your needs and wants.

- Reduce the number of savings goals you are trying to fund simultaneously.

- Extend the deadline for your goal in order to contribute a smaller monthly amount.

- Increase income with a side hustle.

- Put a bonus, tax refund, or monetary gift toward the savings goal.

Step No. 4: Track progress as milestones

To stay on track, break down savings goals into small milestones. Then check each one off as you go. Seeing how far you’ve come is a great motivator to keep up the momentum.

For instance, create short-term savings goals as you work toward a long-term goal. A large savings goal is daunting, making it difficult to stay on track. Completing small milestones gives you the satisfaction of meeting a goal with each contribution.

Try visualization to track goal progress. It’s a technique that helps you associate your goals with a visual aid for added structure. Consider using a bullet journal, a chart, a spreadsheet, or another visual marker to show progress as you complete each milestone.

Don’t forget to celebrate progress with each milestone achieved. This is a reminder of how small actions add up over time, leading to big motivation.

Tips to stay on track with savings goals

We spoke to financial professionals to hear their top tips on how to stay motivated to cross the finish line on savings goals.

No. 1: Create a meaningful and specific goal

Create a savings goal that is both meaningful and specific. This might look like the exact dollar amount needed to make a purchase or to cover three months’ worth of expenses. Don’t set an arbitrary dollar amount and call it a day.

“[S]etting a number goal is not meaningful,” said Wesley Botto, CPA and founder of Botto Financial Planning & Advisory. “It will not prevent you from making an impulse purchase. However if you sit down and really think about your priorities, then your goals will carry out in your daily life.”

Make it a habit to return to financial goals and determine if they're still working. It’s OK if a savings goal changes according to life priorities. In fact, the best goals are meaningful, specific, and flexible.

No. 2: Pay yourself first

Ensure that savings goals remain a priority in your budget by enrolling in direct deposit. Automatically depositing money to savings takes the decision-making process out of human hands.

Direct deposit all or some of your paycheck into a savings account. Many companies allow their employees to direct deposit a certain percentage of their earnings into different bank accounts.

“Then on pay day, figure out how much you need to pay those essential bills and transfer [that amount of money] into your checking account,” said Danijel Velicki, founder and CEO of Sqwire and Opus Wealth Strategies, LLC.

This way you can contribute to your savings goals before the money ever reaches your checking account.

“Seeing the number in your checking account drop when you transfer that money can create an emotional response,” Velicki said. “It forces you to think about how bad you really want that item, whatever it may be. The extra time to transfer the money will often make you decide that you don't want or need to make that purchase.”

Bottom line

Saving isn’t just about the money in your bank account. It’s a commitment to set and achieve financial goals.

Wesley Botto is a certified public accountant and partner at Botto Financial Planning & Advisory. He pursued an undergraduate and master’s degree in accounting. He believes there is nothing better than helping clients properly align their objectives with their strategic actions; his clients include physicians, lawyers, and business owners.

Danijel Velicki is the founder and CEO of Sqwire and Opus Wealth Strategies, LLC. A Croatian immigrant, Velicki arrived in the United States with just $40 in his pocket nearly 25 years ago. He has spent the last 17 years in the financial and insurance services arena, building himself into a premier voice and leader in the industry. He has received honors such as Inside Business’ 40 Under 40, and Hampton Roads Entrepreneurial Excellence Award.