Are You an Emotional Spender?

Shopping is a form of instant gratification. Buying a new car or dress can provide a quick self-esteem boost. That’s because spending money is tied to our emotions.

While it makes us feel good to buy shiny new toys, we also adjust to new purchases quite rapidly, so it’s easy to feel the need to go back to the brick-and-mortar retailers or online to buy something else.

“Retail therapy is a band-aid,” says Megan McCoy, Ph.D., an Assistant Professor at Kansas State University. It can also be an attempt to combat feelings of loneliness, insecurity, boredom, and fear, as well as to relieve stress.

There’s nothing wrong with feeling a quick pick-me-up from a purchase if you’re having a bad day. However, McCoy says, “If you’re using it all the time, it’s not really going to lead you to a more sustainable happiness.”

If you’re constantly chasing the high of a shopping spree to avoid negative emotions, it may be time to take a look at your spending habits, especially if they are leading to negative financial consequences, such as credit card debt from overspending.

With that in mind, here are five steps to help you overcome harmful emotional spending.

1: Identify the emotion behind your impulse purchases

“Most spending has an emotional component to it,” says Natasha Knox, a certified financial planner.

When you put that new item in your basket at the store or online shopping cart, take note of what you’re feeling by asking yourself the following questions:

- What emotion are you currently feeling?

- Why am I shopping in the first place?

“Every single decision you’re making is connected to a need, and some of these needs aren’t filled by spending, so increase the awareness of the emotion you’re feeling,” Knox says. “Was there a universal human need that you were trying to meet and how should you be meeting it moving forward?”

"Pinpointing the exact emotional need you’re filling when you emotionally spend can make it easier to find cheap or free solutions that can lead to sustainable happiness," McCoy says.

2: Understand your spending habits

“Even though our rational minds understand why we shouldn’t buy, there’s an even bigger desire to spend,” says Doctor Alex Melkumian, a licensed marriage and family therapist and founder of the Financial Psychology Center. “It’s a self-destructive behavior.”

These behaviors can manifest in more than one way: by impulsive or compulsive buying.

"Impulsive and compulsive buying are two types of emotional shopping motivated by making yourself feel better from negative emotions," says Grant Donnelly, Ph.D., an Assistant Professor of Marketing at The Ohio State University who studies judgment and decision-making.

Impulsive buying involves not fully processing purchases and buying things on a whim. Compulsive buying, on the other hand, is often triggered by mental health issues, such as Obsessive-Compulsive Disorder, addiction, or anxiety. With compulsive buying, the act of buying does not necessarily focus on the object that has been purchased, but more so on the act of spending money.

“When you fall below your standards, you’re more inclined to overspend and make a compulsive or impulsive purchase as a way to regulate your emotions,” Donnelly says.

While it may be difficult to look at your bank account, reviewing your purchase history can help identify your spending patterns and shopping habits.

“If you’re spending impulsively, some people don’t want to look at that part of themselves and their behavior, so they’ll bury their heads in the sand,” Melkumian says.

It’s common for feelings of self-judgment, guilt, and shame to emerge going through this exercise. It may help to do this with a financial therapist who can provide financial and emotional guidance.

3: Find your emotional triggers

Triggers for emotional spending will vary from person to person. Relational stress and work stress are two common triggers McCoy has seen with clients.

“When you feel like retail therapy, what were you doing and what or who were you interacting with?” McCoy asks. "By pinpointing the exact emotional need you’re filling when you’re making emotional purchases, it’ll be easier to find cheap or free solutions which can lead to sustainable happiness," she says.

Emotional spending can also become a reflex, even without a trigger. Being in specific environments may generate the urge to shop and make poor financial decisions even if you don’t need anything.

4: Develop sustainable strategies for dealing with stress

It can be easy to use retail therapy for a quick lift, but it can become problematic when it’s the only tool to help lift you out of a slump.

“Buying things more hedonic such as candy and designer goods can improve mood, but these aren’t lasting,” Donnelly says. “They are part of an effort to improve your life, but it’s not successful in improving circumstances, so you feel worse.”

Therapist Virginia Satir’s self-care mandala embraces eight universal human needs to fulfill, which McCoy says can be a starting point to find other sources of happiness:

- Intellectual

- Interactional

- Emotional

- Nutritional

- Sensual

- Spiritual

- Physical

- Contextual

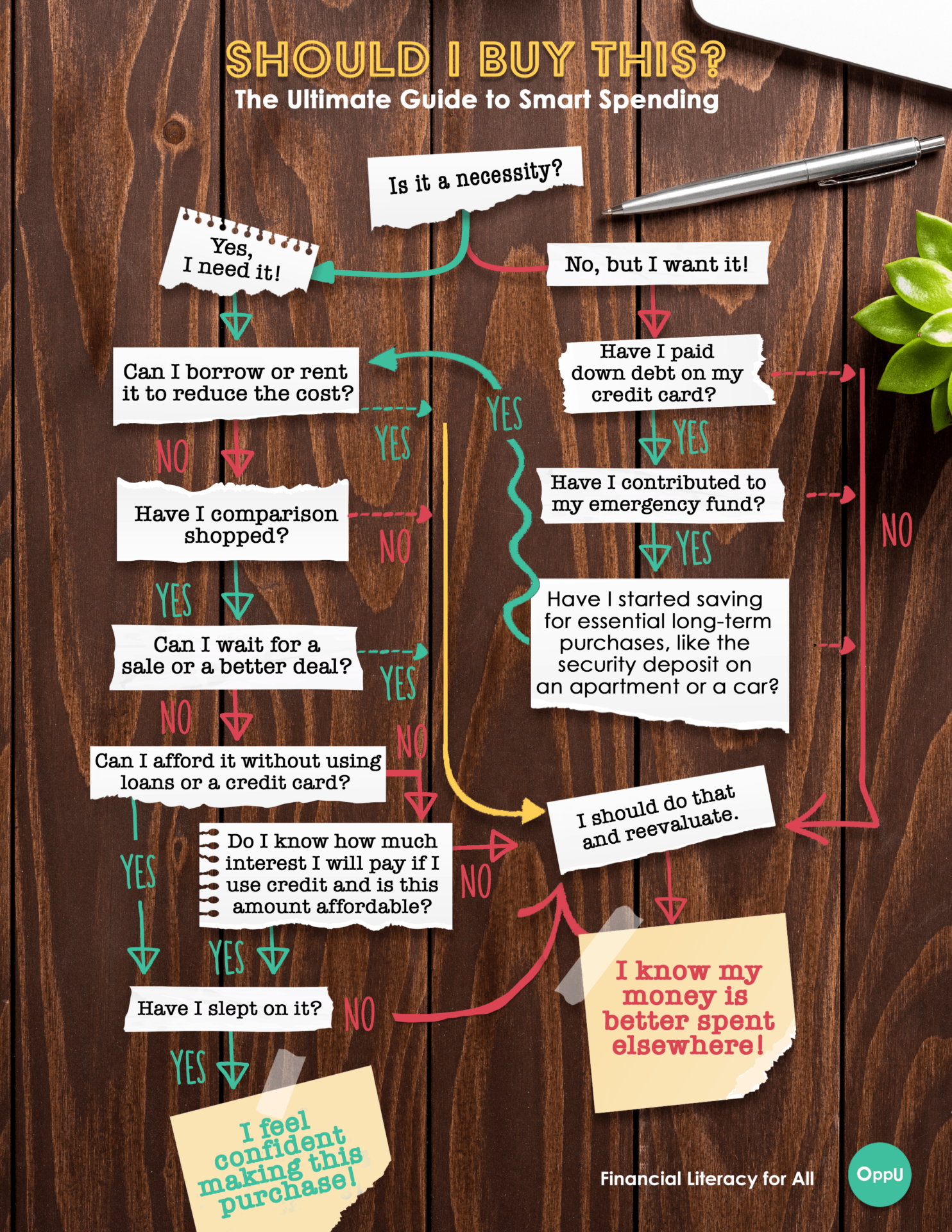

The key point is this: spending money shouldn’t be the only way to improve our lives. If you aren’t sure about whether or not you should splurge on a purchase, check out the spending guide from OppU below, which can help identify if you are showing signs of emotional spending habits.

5: Introduce money management behaviors

Managing money is a core issue to master and it can be a slow process.

“There’s no magic pill to make you thin, and there’s no magic pill to master your finances, but persisting and addressing the numbers will eventually feel good,” Melkumian says.

In his research, Donnelly has found that when you don’t keep track of your finances, it leads to behaviors that go against your financial goals and well-being. On the other hand, practicing basic money management habits, such as organizing receipts, budgeting, and paying off credit card debt, can actually make you feel better and more secure about your personal finances.

“Positive financial behavior leads to wealth accumulation, which leads to more positive money management,” Donnelly says. “You’ll be less likely to think that acquisition of new items will solve your problems.”

Grant Donnelly, Ph.D. is an Assistant Professor of Marketing at The Ohio State University’s Fisher College of Business. His research has been published in journals and media outlets across the country and focuses on how consumers can be encouraged to make decisions that improve their financial, physical, and social health. Additionally, his research has been published in "Psychological Science," "Journal for the Association of Consumer Research," and "Psychology Bulletin" among others, and has been featured in popular press, including Harvard Business Review and The Wall Street Journal.

Natasha Knox is a certified financial planner and the Principal of Alaphia Financial Wellness. Knox holds a graduate certificate in financial therapy from Kansas State University. She believes in giving back to her profession and serves on the board of directors of the Financial Therapy Association.

Doctor Alex Melkumian is a licensed marriage and family therapist and founder of the Financial Psychology Center in Los Angeles. He is devoted to helping clients improve their financial and mental health by uncovering patterns in their relationship with money that keep them stuck and suffering. Specifically, he has worked with athletes to improve their financial wellness and overall performance. As athletes train with a singularity of focus to excel in their field, they often experience stress in other areas of their lives, such as finances. Helping clients understand how those factors interplay revitalizes their emotional and financial health.

Megan McCoy, Ph.D., a licensed marriage and family therapist and a Level-1 certified financial therapist, is an Assistant Professor at Kansas State University where she teaches courses for the financial therapy certificate program. She is also the secretary for the board of financial therapy and was the associate editor of profiles and book reviews for the “Journal of Financial Therapy.”