How to Read Your Credit Card Statement

When it’s time to pay your credit card bill, you skim your credit card statement for the total balance. You check the damage.

Ouch. Why do you owe so much?

Those other numbers might be a clue, the percentages, the financial terms — if only you knew what they meant. The percentages. The financial terms. The barrage of information is overwhelming.

It’s tempting to throw all of it in the recycling, but your statement is a great way to put your spending under a microscope. It tells you where your money is going and can offer ideas for how to redirect it in healthy ways. And there’s always the chance of a mistake or fraud. If you know how to read your statement, you’ll have a better chance of catching it quickly.

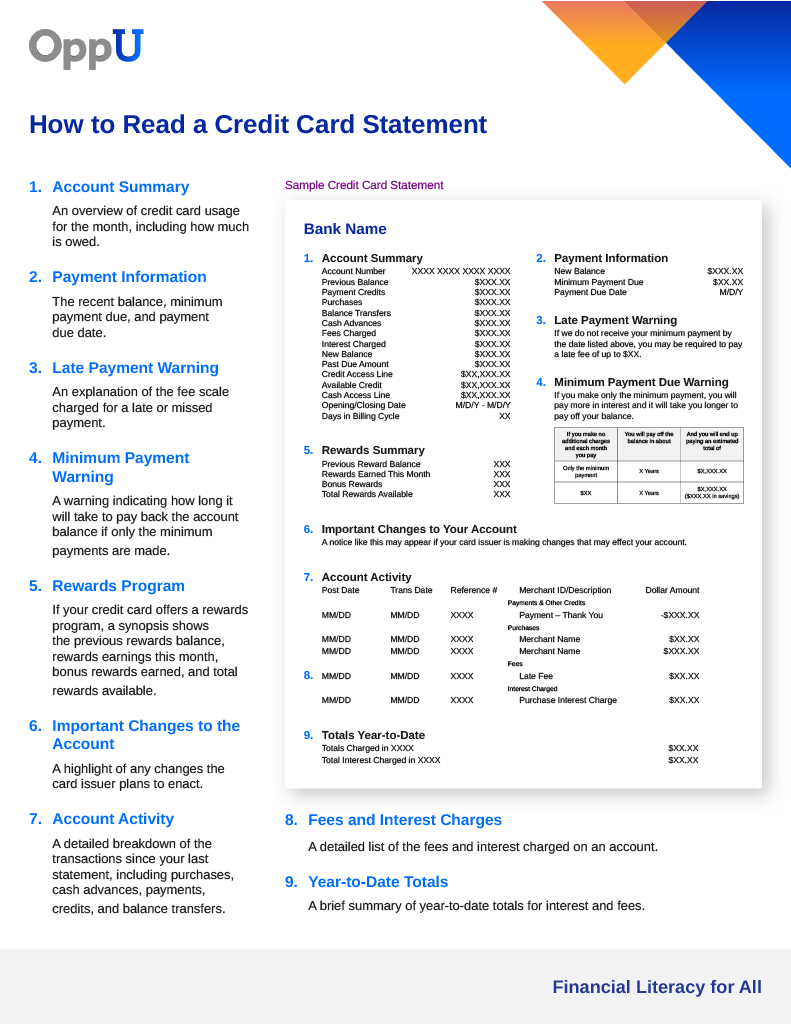

To help you understand how everything adds up, we outlined each section you’re likely to see. Here’s what it all means.

Sample credit card statement

1. Account summary

An overview of your credit card usage for the month, including how much is owed.

The account summary lists all of the account transactions — payments, credits, purchases, balance transfers, cash advances, fees, interest charges, and amounts past due. It also includes key pieces of information, such as the account number, previous balance, new balance, credit limit, and available credit.

2. Payment information

Payment information is arguably the most important section of a credit card statement. It provides the recent balance, minimum payment due, and payment due date.

The new balance is the total amount due on a credit card. The minimum payment due is the amount you must pay to remain in good standing. The payment due date is when the credit card issuer must receive your payment.

3. Late-payment warning

An explanation of the fee scale charged for a missed or late payment. If it’s your first offense, the card issuer likely won’t charge the highest fee amount. The late fee is added to your balance and you could pay interest on it if you carry the balance over.

For more information on late payment penalties, check your cardholder agreement.

4. Minimum-payment warning

A warning for how long it will take to pay back the credit card account balance if only minimum payments are made. It may also include a comparison chart showing the effects of paying more than the minimum payment. In this case, the credit card debt will decrease faster.

If you’re having difficulty making payments, contact your credit card issuer to discuss options.

5. Rewards program

A rewards summary is included if your credit card offers this type of program. This section includes information on the previous rewards balance, rewards earnings this month, bonus rewards earned, and the total rewards available.

6. Important changes to the account

A highlight of any changes the credit card issuer plans to enact. It will list the type of change, how it will impact your account, and when it will take effect.

Changes might only apply to your situation, such as triggering a penalty APR (annual percentage rate), or might apply to all cardholders.

Contact your credit card issuer for more information.

7. Account activity

All of the transactions since your last statement. This section of your statement includes purchases, cash advances, payments, credits, and balance transfers. A detailed breakdown of fees and interest incurred is also included for those who made a cash advance or balance transfer.

Credit card companies may organize this section by the date of transaction, type of transaction, or account user.

Pay attention to the account activity section. Review the list of charges carefully to make sure you recognize all of the transactions. Report any unauthorized transactions immediately to the credit card issuer. Remaining vigilant helps protect against mistakes and fraud.

8. Fees and interest charges

A detailed list of the fees and interest charges on an account.

Cardholders can pay a hefty price to borrow money from a credit card issuer. There are annual fees, foreign transaction fees, cash advance fees, late payment fees, returned payment fees, balance transfer fees, and overlimit fees.

Those who carry credit card balances month to month are also charged interest on the unpaid balance. Interest charges are listed on the statement according to the type of transaction — purchases, balance transfers, and cash advances. Each type of transaction may have a different interest rate. This section of your statement should explain the different interest rates you could be charged.

9. Year-to-date totals

A brief summary of year-to-date totals for interest and fees. Use this information to track how much it actually costs to use your credit card. For instance, paying a large sum in interest might help you reconsider making a purchase if you can’t pay the balance in full.

What is a credit card statement?

A credit card statement, also called a billing statement, is a monthly summary of your credit card transactions. It details purchases, payments, fees, interest charged, and your current balance.

It’s important to understand the information included in each section of your statement.

When is a credit card statement delivered?

A credit card billing statement is delivered to the account holder at the end of a billing cycle — typically once a month.

Expect to receive your statement in a timely manner. The Credit Card Accountability Responsibility and Disclosure Act of 2009 (CARD Act) requires a credit card issuer to deliver a billing statement at least 21 days before the monthly payment due date. If they fail to do so, they can’t charge late fees for the billing cycle.

Account holders may choose to receive their monthly statements by mail or online. Paper statements are mailed to the account holder’s physical address. Paperless billing is accessed online. Simply sign in to your account to access your electronic credit card statement. Whichever delivery method you prefer, make sure your credit card issuer has your correct mailing and email address on file so you receive your statements promptly.

Why are credit card statements used?

A credit card statement is filled with important information. It provides a detailed breakdown of charges, fees, and interest accrued.

Understanding your statement can help you better understand your spending. It can also help you spot any mistakes or fraud and report them in a timely manner.